How to Successfully Close on a New Home

Buying a house is overwhelming, especially for a first-time homebuyer. But with the right preparation, you can take control and avoid the most common homebuying hurdles. We’ll show you how.

Read more

Buying a house is overwhelming, especially for a first-time homebuyer. But with the right preparation, you can take control and avoid the most common homebuying hurdles. We’ll show you how.

Read more

Don’t let these common first-time homebuyer myths and misconceptions scare you away from buying your dream home.

Read more

Historical data tells us that for most borrowers in the last 25 years, paying points has been a bad decision.

Read more

Thinking about using an online lender to buy or refinance your home? Get pre-approved for a mortgage online quickly and easily with Better Mortgage, on your schedule and on your...

Read more

Get answers to your questions about escrow accounts - what is an escrow account, how does it work, and whether escrow for taxes and insurance is necessary.

Read more

They didn’t think homeownership was in the cards. Now they’re living a life of leisure in Florida.

Read more

An appraisal contingency helps prevent homebuyers from overpaying, but sometimes they cause offers to be rejected. Learn when to add it, when to waive it.

Read more

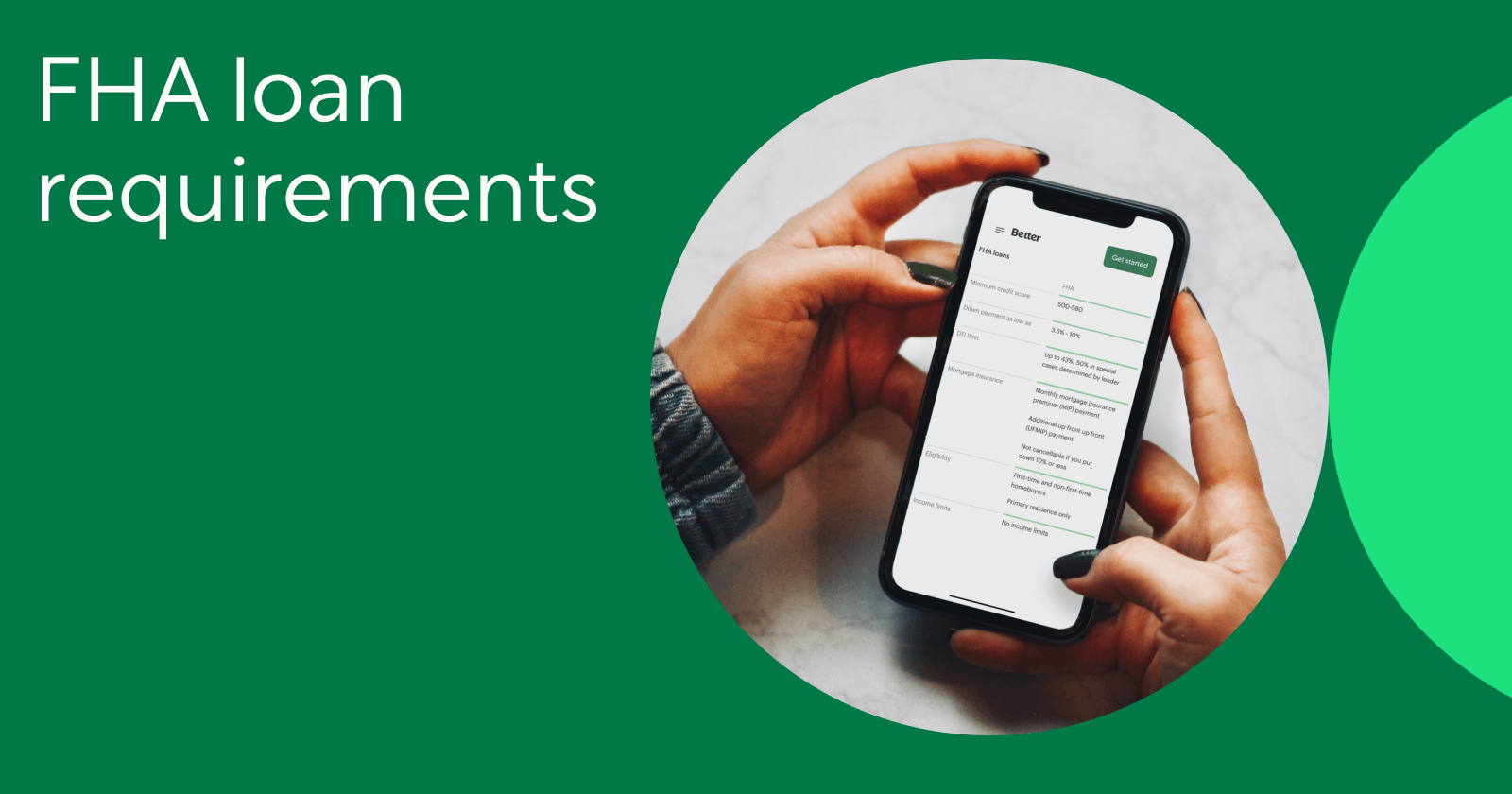

A guide to breaking down the federal and lender-specific requirements to qualify for an FHA loan and determining if this lending option is a good fit for you.

Read more

Here’s an intro to how FHA loans work, how to qualify, and which types of borrowers might be a good match for this type of mortgage.

Read more

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

Here’s what our underwriters take into consideration when reviewing applications from self-employed borrowers.

Read more

Choosing the right neighborhood is one of the most important (and difficult) parts of buying a house. Here are some tips to help you make that decision.

Read more

There is more to a mortgage than meets the eye. Here’s what a mortgage really is, how it works, and the different options available.

Read more

Considering an out-of-state move? Don’t overlook these cities with lower costs of living and affordable homebuying options.

Read more

Can you qualify for a mortgage? You might want to check your credit score. Learn how lenders handle your credit score and how you can improve it.

Read more

Low-income homeowners who were previously denied a mortgage refinance may now qualify through RefiNow™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Mortgages aren’t one-size-fits-all. To help you assess your options, learn all about understanding different home financing options.

Read more

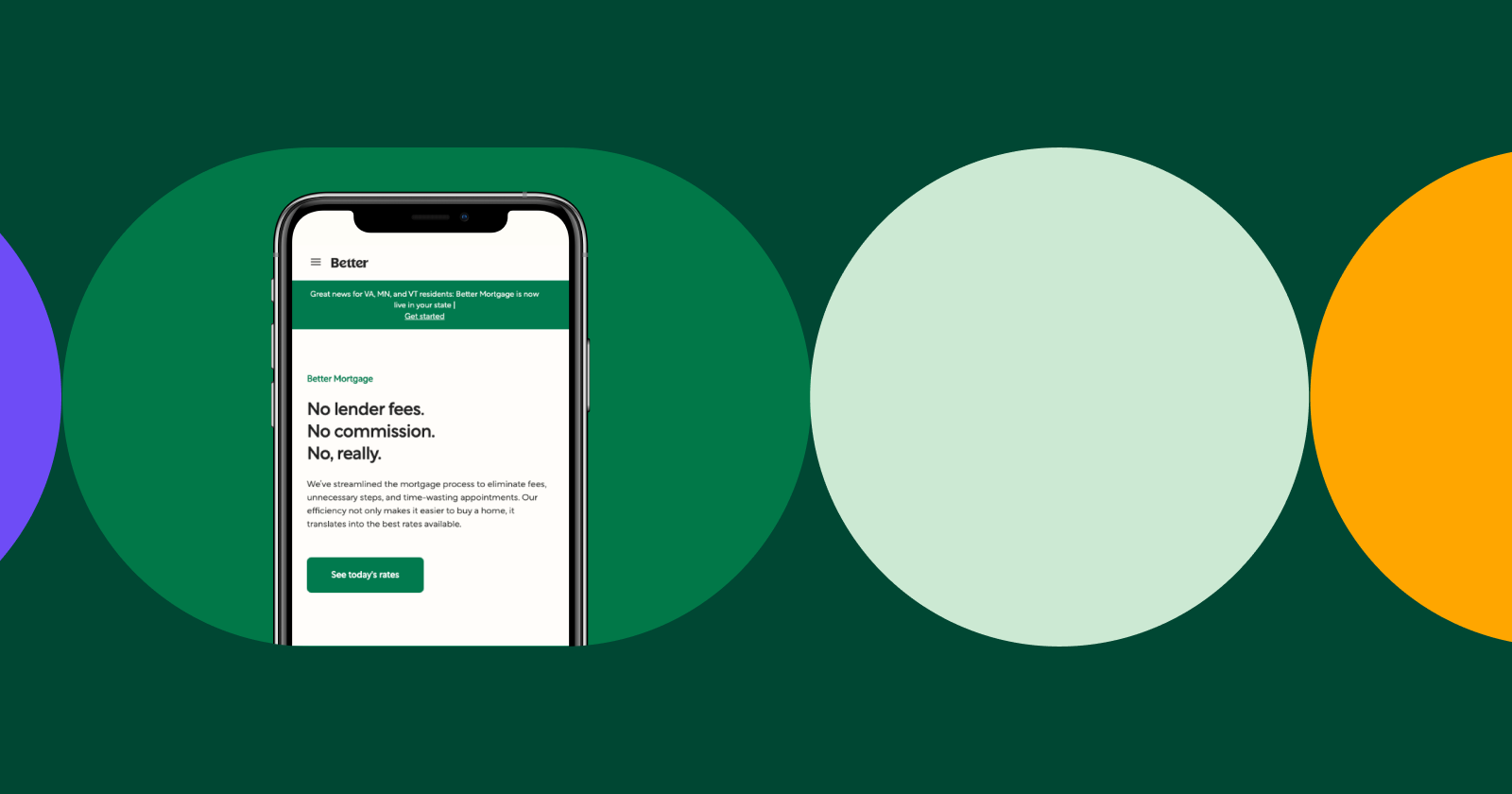

Should you apply for a digital mortgage? Online lenders offer a wide range of benefits for homebuyers and refinancers who are looking to save time and money.

Read more

Your down payment is the biggest upfront cost of your mortgage. Learn about down payment requirements and other best practices.

Read more

Is that home really for sale? Learn what it means when you see "contingent" vs "pending" next to a real estate listing—and when you can still put in an offer.

Read more

Need something else? You can find more info in our FAQ