Which Loan Fits Your Needs? Types of Conventional Loans: An Overview

Conventional loans offer plenty of perks. But which is best? Our overview of different types of conventional loans will help you pick the best one for you.

Read more

Conventional loans offer plenty of perks. But which is best? Our overview of different types of conventional loans will help you pick the best one for you.

Read more

Builders are ramping up to meet homebuyer demand, and the fresh inventory could help cool off rising new home prices.

Read more

Better compiled a list of 15 events and milestones in the history of the American mortgage system, using information from news articles, encyclopedias, and historical literature.

Read more

Next year is expected to bring slower price growth, rising rates, and more competition. Getting the ball rolling now could help borrowers save.

Read more

The Federal Reserve will be rolling back its pandemic relief measures, which helped keep rates near record lows since 2020. Find out what it means for borrowers.

Read more

Buying a home isn’t impossible for low income families. In fact, there are loans designed to help. Learn which ones to look for in our low income loan guide.

Read more

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

Rates are starting to rise and new inventory is on the way. Both will likely slow down price growth, and provide more options for homebuyers.

Read more

When the phrase “master bedroom” first came into use, the homebuying industry heavily favored white, cisgendered men.

Read more

Refinancing your mortgage? You may want to buy down your interest rate by purchasing points, which can save you thousands over the life of your loan.

Read more

A guide to navigating first time homebuyer loans, grants, and programs to make sure you get the most bang for your buck.

Read more

A new announcement from the Federal Reserve could mean the end of low rates—but that may not be bad news for buyers and homeowners.

Read more

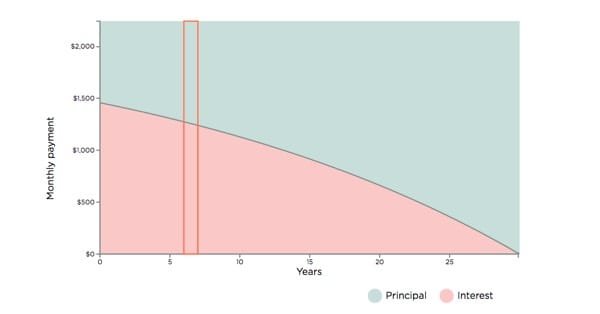

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

Home prices continue to rise, but the holiday season could spell opportunity for some. See multiple ways first-time buyers can get a competitive edge.

Read more

Learn how to compare mortgages, first-time homebuyer assistance programs to apply for, and why the amount you’re pre-approved for shouldn’t be your offer price.

Read more

Homebuyers are paying more at closing than they did in 2020, but choosing the right lender and loan options can help you save on a new home.

Read more

Closing costs are going up around the country, but choosing the right lender can help you save more on a new loan.

Read more

Use mortgage points to buy down your interest rate when purchasing or refinancing a home. Learn how it lowers interest rates and saves you money over time.

Read more

To help buyers keep up with record high home prices, the FHFA is raising the limit on conforming loans—and it could help you save on a home.

Read more

Need something else? You can find more info in our FAQ