A guide to understanding your Closing Disclosure

The Closing Disclosure is a standard form that lays out the final details of your mortgage. Here is a guide to understanding your Closing Disclosure.

Read more

The Closing Disclosure is a standard form that lays out the final details of your mortgage. Here is a guide to understanding your Closing Disclosure.

Read more

Mortgage News: The Federal Reserve intends to keep interest rates near zero in an effort to speed economic recovery.

Read more

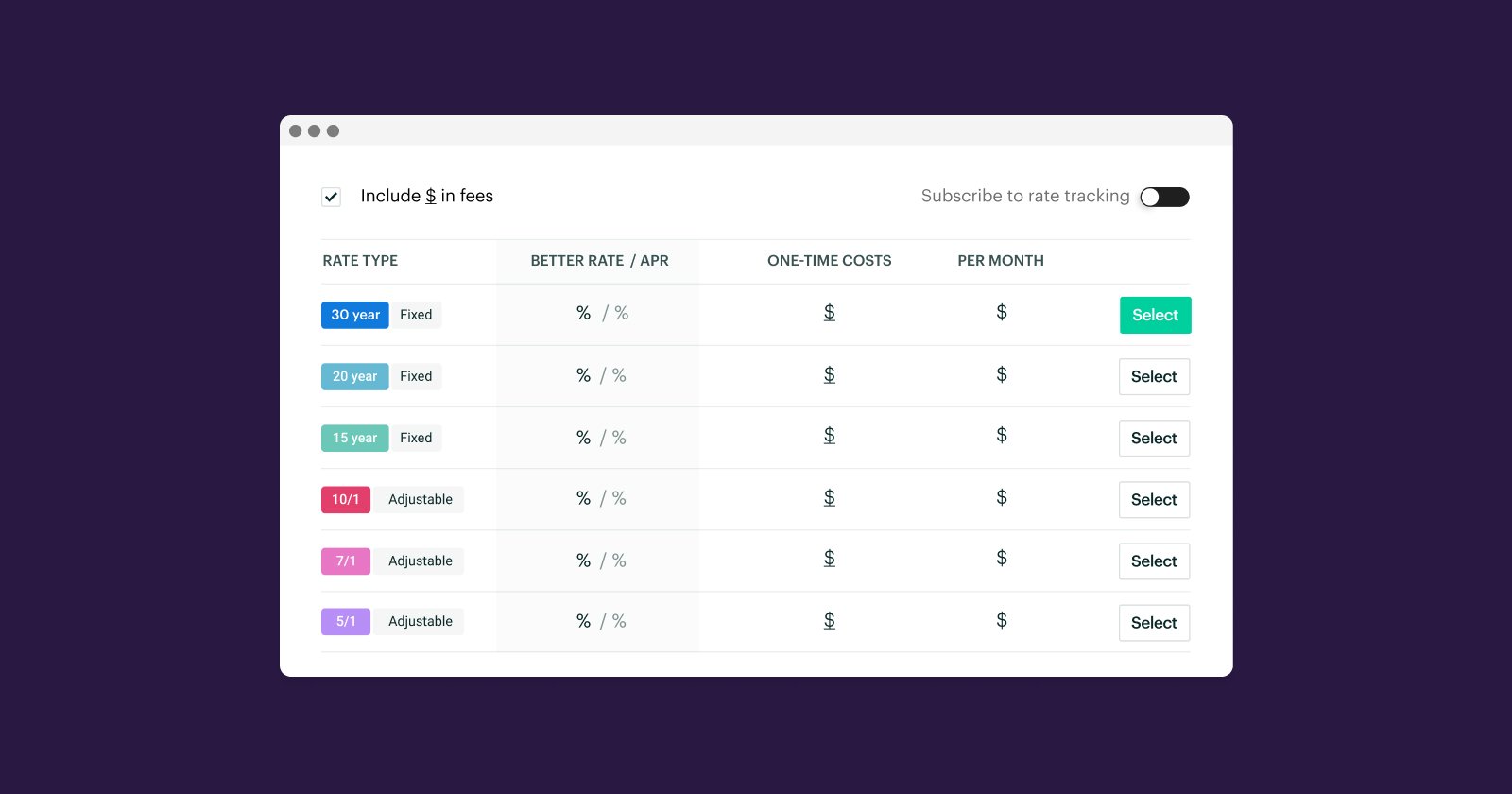

Learn how to read a mortgage rate table—a powerful comparison tool to help you choose the best home loan for your needs—in this new article from Better Mortgage.

Read more

Second mortgages can be used to pay off debts, but they do come with risks. Learn about HELOCs, home equity loans, and piggyback loans in this new Better Mortgage article.

Read more

Buying a house? Learn how your property type—primary residence, second home, or investment property—affects your mortgage rates, including investment property mortgage rates vs primary residence.

Read more

Thinking of applying for a home loan? Learn the pros and cons of a 15 year vs. 30 year fixed rate mortgage in a new article from Better Mortgage.

Read more

If you’re applying for a mortgage or refinancing, you’ll need to “lock” your rate during the loan process. Here’s a breakdown of what exactly that means.

Read more

APR and interest rate represent two different things. Learn the difference between mortgage interest rate vs APR and how to determine the true cost of your mortgage.

Read more

When you’re looking to buy or refinance a home, there are 3 major factors that can make or break your mortgage application approval. Find out what they are.

Read more

To celebrate National Intern Day, a former Better.com intern will walk first-time homebuyers through homeownership lessons he learned during his internship.

Read more

Learn how to navigate buying a new construction home—from the home loan process, through assembling your team, and how you can avoid predatory lenders.

Read more

Go from planning to closing with the complete home buying checklist—most of which can now be completed online with the help of Better.

Read more

Interested party contributions can help, but also complicate closing your mortgage. Know the ins and outs to get the most out of your party contributions.

Read more

Rent-to-own is an alternative to buying a home outright. For those who might not qualify for a traditional mortgage, rent-to-own offers a path to ownership.

Read more

The CARES Act makes it easier for those affected by COVID-19 to put their mortgage into forbearance—but a refinance might be a better option.

Read more

Gifts letters are common in financing the down payment for a home. Find out the benefits and drawbacks of using gift funds towards your mortgage.

Read more

Discover what affects a home appraisal for refinance, including how cleanliness and other factors may influence its value. Learn what appraisers look for and how to prepare your home.

Read more

Better Settlement Service’s comprehensive guide to the title fees and closing costs associated with buying or refinancing a home.

Read more

Attention, New York homeowners: a CEMA loan can save you thousands in taxes when buying or refinancing property that's already mortgaged in the state.

Read more

Amidst a record drop in consumer confidence, and low returns on traditionally safe investments, the Fed moves to make more credit available to consumers.

Read more

Need something else? You can find more info in our FAQ